An Overview of Blockchain Technology: Part 2

An Overview of Blockchain Technology: Part 2

This blog is a two-part series on blockchain, a game-changing distributed ledger technology (DLT). Part 2 focuses on smart contracts and a description of the plethora of innovations and opportunities enabled by blockchain technology in diverse fields of endeavor. (See Part 1 here.)

Blocks in a chain contain a collection of facts. In part one of this overview we focused on facts primarily as data. However, facts composing a block can contain more complex structures or contracts. For example, a fact may be a small executable program or a mini-database with associated actions to perform on its data. In such instances, each node throughout the global network would execute the mini-program or method on the database, when accessing this specific contract within the block. This facilitates the implementation of a composite or smart contract, as part of the distributed consensus enactment of the global network.

SMART CONTRACTS

Smart contracts are powerful, game-changing instruments that enable new methodologies for transactions. Consider the legal contract prevalent in our global society. It requires a middle man (e.g., bank, lawyer, ebay, Amazon) for enforcement or dispute resolution. A smart contract can be viewed as a technology-enforced contract, built upon blockchain technology. It also enables specific, automated actions that provide a service for the participants. Among two or more parties desiring to enter into contract, it facilitates a fast, accurate action (e.g., a transaction) with all the necessary data, dates, etc. included. It is a comprehensive methodology with inherent disintermediation. Furthermore, information is permanently stored and cannot be lost, including the entire history and record of the entity, data, record, etc. The Ethereum project has the most popular blockchain technology that leverages smart contracts.

IEEE Spectrum defines a smart contract as:

“Software-based agreements deployed in systems capable of automatically executing and enforcing the terms of the contracts.”

Smart contracts provide autonomy, trust, backup, safety, speed, savings, accuracy and security. Examples of smart contract uses can range from government and financial services to supply chain and healthcare. Furthermore, 12 game-changing uses include digital identity, records and land title recording.

See this smart contracts infographic.

THE OPPORTUNITY

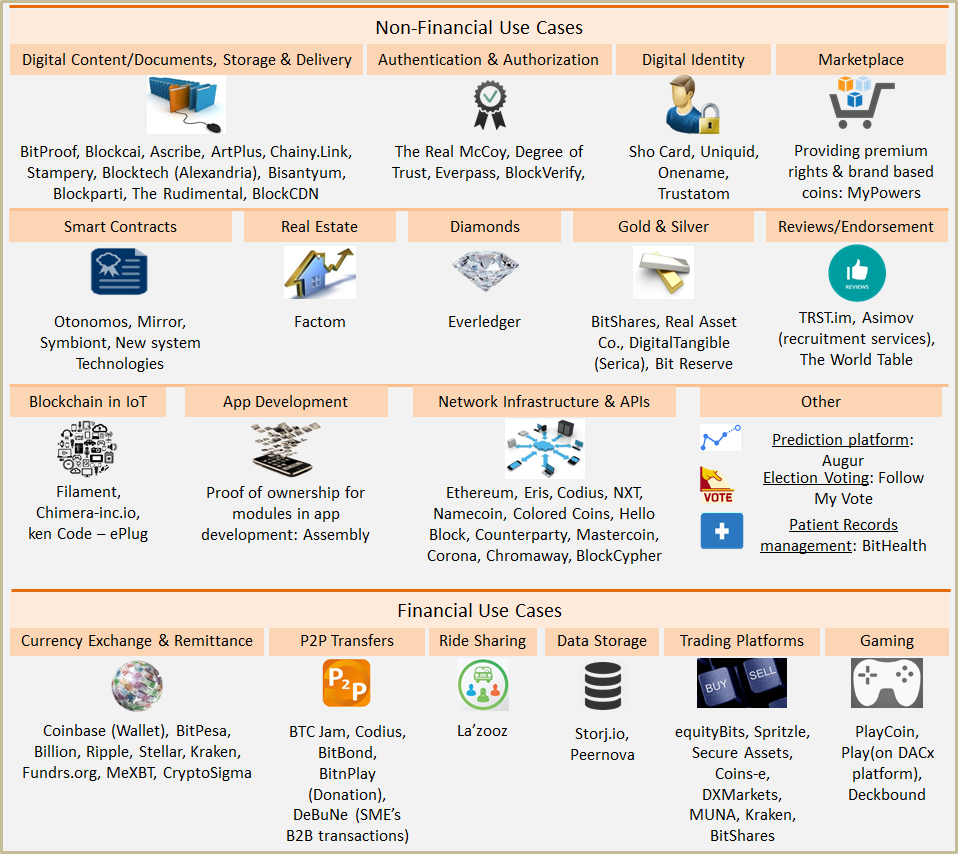

Figure 1. Blockchain Use Cases. (Source: Let's Talk Payments).

Blockchain technology, and the associated smart contracts, has the potential to disrupt operational capabilities in several fields of endeavor. Some of these include financial services, supply chain management, healthcare services, real estate, energy and government services. For example, government pilot projects leveraging blockchain exist in the U.S. state of Illinois, and the city of Dubai in the United Arab Emirates. An energy pilot is under development in Brooklyn, NY. The finance industry has created the R3 consortium to consider opportunities relevant for that industry. Listed below is summary of these projects:

- Government Services. The Illinois Department of Commerce and Economic Opportunity is looking to develop several pilots based upon smart contracts and blockchain technology. Each project is free to develop its application and associated technology and there is no coordination among the projects. In contrast, Dubai plans to develop one central blockchain that will be leveraged by 25 agencies to develop pilots this year, with the intention rolling out the most successful in 2018.

- Energy. LO3 Energy is leveraging a TransActive Grid to evaluate the viability of distributed energy generation and consumption locally. The Brooklyn microgrid is based upon the supply and demand for renewable sources and TransActive Grid blockchain technology.

- Financial Services. R3 is a consortium of over 100 global banks and other financial institutions that has developed Corda, a permissioned (or private) distributed ledger technology (blockchain) specialized for the finance industry. It works to address issues such as government regulation and the need to know your customer (KYC). There is no associated cryptocurrency for Corda.

In addition to these examples, there are a plethora of use cases and projects ongoing or in the works worldwide. Included in Figures 1 and 2 is an overview of many of them.

Figure 2. Non-Financial and Financial Use Cases. (Source: Let's Talk Payments).

SUMMARY

Leveraging blockchain technology is a factor in the planning and strategies of numerous entities in various fields of endeavor. With smart contracts, distributed consensus, trust, security, and efficiency, it can potentially disrupt many transactional and other processes worldwide, creating $billions+ in new market opportunities. This 2-part series presented an overview of this game-changing technology.